雇員點評標簽

職位描述

Key Responsibilities

- Plan and project-manage tax compliance assignments, including monthly/quarterly filing, tax accounting, invoice management, etc.

- Support on tax compliance filing, including review/prepare indirect and direct reconciliation and tax returns, VAT export refund, the payment to overseas under non-trade for China tax related part, etc.

- Act as the primary point of contact for client liaisons

- Attend to follow-up questions from tax authorities

- Work and interact with multidisciplinary teams

- Transformative mindset and willing to learn new technology and process

- Lead team and provide supportive environment for staff development and motivation

Experience & Background

- Bachelor degree in Accounting / Finance / Economy or Business related discipline

- Minimum of 3-5 years’ experience in a professional service environment or in-house tax department

- Excellent knowledge of China tax laws and regulations

- Proficient in English writing and speaking

- Good communication skills

- Good project management skills

- Multi-tasking skills and ability to meet deadline under time pressure

- Well-organized, detail-oriented, problem solving and analytically minded

- Self-starter and good team player

工作地點

相似職位

- 稅務(wù)會計6000-7000元

佛山 - 南海

廣東成章建設(shè)工程有限公司 佛山 - 南海

畢馬威全球商務(wù)服務(wù)(廣東)有限公司

畢馬威全球商務(wù)服務(wù)(廣東)有限公司- 稅務(wù)會計主管1-1.4萬

佛山 - 南海

廣東珠江電線電纜有限公司

廣東珠江電線電纜有限公司 - 出口退稅會計5000-7000元

佛山 - 南海

佛山市迅迅電子商務(wù)有限公司

佛山市迅迅電子商務(wù)有限公司 - 助理經(jīng)理 (增值稅團隊)MJ0047341.1-1.9萬

佛山 - 南海

畢馬威全球商務(wù)服務(wù)(廣東)有限公司

畢馬威全球商務(wù)服務(wù)(廣東)有限公司 - 稅務(wù)主管1.5-2.5萬·14薪

佛山 - 禪城

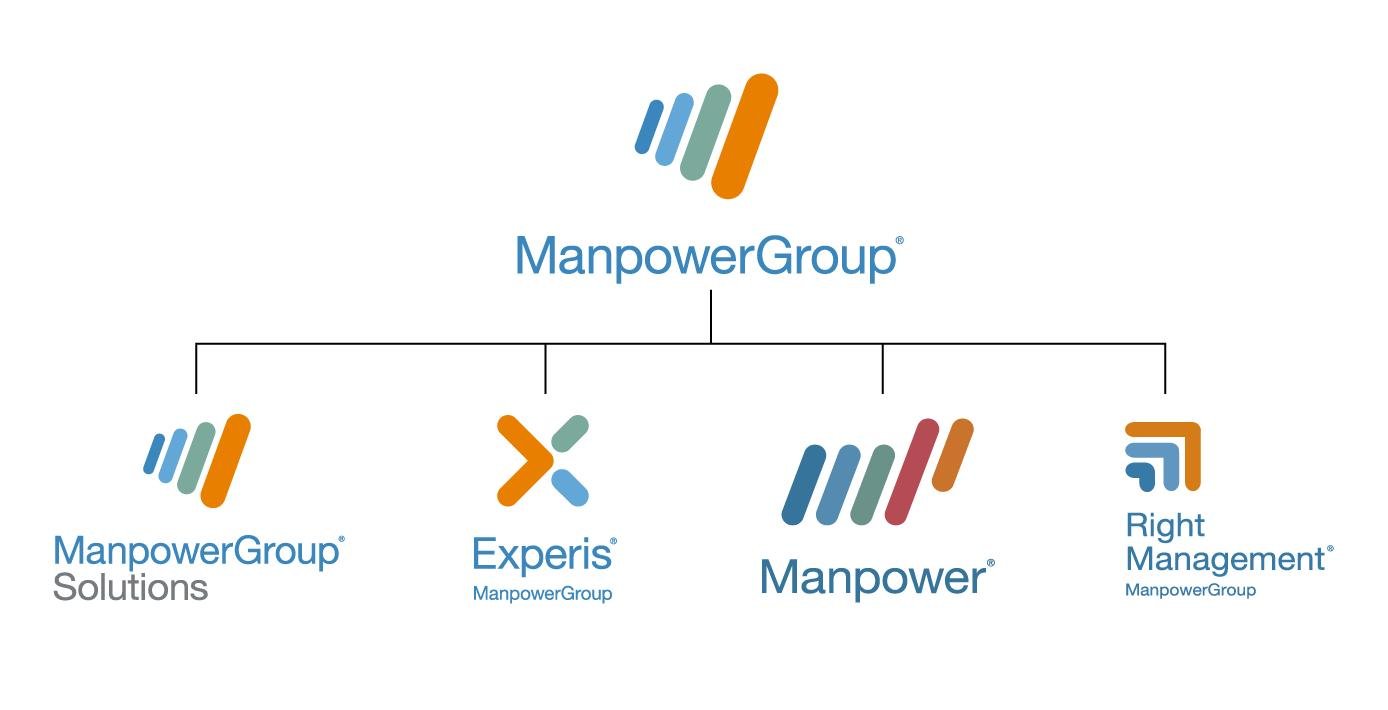

萬寶瑞華人才管理咨詢(上海)有限公司

萬寶瑞華人才管理咨詢(上海)有限公司

- 霸王茶姬招聘

- 肯德基招聘

- 順豐招聘

- 美團招聘

- 京東招聘

- 餓了么招聘

- 比亞迪招聘

- 中國一汽招聘

- 北京汽車招聘

- 蔚來招聘

- 東風汽車招聘

- 長城汽車招聘

- 奇瑞汽車招聘

- 理想汽車招聘

- 長鑫存儲招聘

- 天江藥業(yè)招聘

- 藍月亮招聘

- 安踏招聘

- TCL招聘

- 海信招聘

- 聯(lián)想招聘

- 海康威視招聘

- 寧德時代招聘

- 中興招聘

- 新松招聘

- 京東方招聘

- 申通招聘

- 圓通招聘

- 中通招聘

- 百世物流招聘

- 德邦物流招聘

- 麥當勞招聘

- 星巴克招聘

- 海底撈招聘

- 蜜雪冰城招聘

- 瑞幸招聘

- 雀巢招聘

- 騰訊招聘

- 百度招聘

- 快手招聘

- 字節(jié)跳動招聘

- 新華網(wǎng)招聘

- 小米招聘

- 招商銀行招聘

- 中信銀行招聘

- 北京銀行招聘

- 興業(yè)銀行招聘

- 交通銀行招聘

- 建發(fā)集團招聘

- 中國移動招聘

- 中國聯(lián)通招聘

- 中國電信招聘

- 中糧集團招聘

- 國藥控股招聘

- 中廣核招聘

- 中國船舶招聘

- 強生中國招聘

- 匯豐中國招聘

- 宜家招聘

- 立邦中國招聘

- 伊利招聘

- 青島啤酒招聘

- 京港地鐵招聘

- 寶馬招聘

- 小鵬汽車招聘

- 華為招聘

- 特斯拉招聘

- 吉利招聘

- 奔馳招聘

- 海爾招聘

- 美的招聘

- 京東方招聘

- 施耐德電氣招聘

- 德邦物流招聘

職位發(fā)布者

李小姐/HR

畢馬威全球商務(wù)服務(wù)(廣東)有限公司

畢馬威全球商務(wù)服務(wù)(廣東)有限公司